“What’s in Chile?”

I asked

myself that when I was applying. Chile, to me, lacked the glamour factor

afforded to Argentina and Brazil and the historical aspect which Peru and

Colombia boast. Chile, to me, was a mystery.

However after completing my first reading for my Contemporary History of Chile. I learned that Chile had quite the rags to riches tale the rest of South America lacks.

The title of my reading: “Hyper-Urbanization of

Chile and the Political and Economic Consequences”

I knew what

urbanization was, I remember reading in 11th grade APUSH about the

urbanization caused by our industrial revolution that lead the U.S.A to become

a leading economy by the 100th anniversary of the Declaration of

Independence. How could a country suffer from Hyper-Urbanization?

Chile had an urbanization process

unlike any other. But in order to understand the process, wee need to take an

additional step back (I’ll be brief). Chile was plagued by a semi-feudal system

that lasted up until the mid 1800’s. The few rich had control over the economy

and in turn, the politics of the country. The poor found themselves living on

land they didn’t own working for people they didn’t respect. Something had to

change.

The mechanization of agriculture,

coupled with the rich grouping together in a small pueblo in the Cordillera

called Santiago and on the coast at Valparaiso caused a massive rush of

population into urban areas at an unbearable rate. Spending was through the roof and it was becoming a problem.

Wait a second… why wasn’t this

good? It didn't take a Harvard Economist to come to the conclusion that massive

amounts of spending was what our U.S. Economy needed to begin the slow climb

out the '08 recession. It doesn’t take someone with a high school diploma to

understand that more people spending more money leads to more wealth. What's going on?

Let’s see what the numbers have to

say. In the years of Hyper-Urbanization (1900-1950’s) Chile found itself

managing about 1%/year. All of this new amount of money being spent, you would

think that Gross Domestic Product (Total amount of money spent in an economy)

would grow much more

Why? Let’s check another statistic.

Along with Hyper-Urbanization,

Chile was experiencing High Inflation (30-50% increase in prices). Prices were skyrocketing and the

Chilean Peso was rapidly losing its value.

How?!

It all heads to the Equation of Exchange (M*V=P*Q ).

M

is the total amount of money in the Economy (the dollar bills you and I and our

bank has)

V

is the velocity of money (how quickly it is spent, the higher the V the harder

it is for banks to hold on the money you and I have because we keep on

spending!)

P

is the price level (Our inflation indicator) and finally…

Q

is our index of expenditures (the amount we spend on goods and services)

With

a little bit of multiplication we get…

(M*V)/Q=P

What does this mean?? Well if Q is

our amount of expenditures, it must be pretty small if we have a huge increase

in inflation. The data agrees

Just a reminder….

The average rate of inflation was

36% during the 1950s, reaching 84% in 1955.

And for GDP growth, as supplied by

Carlos Seiglie, a Professor of the Economics at Rutgers University

“Ballestors and Davis estimated

that the gross domestic product (GDP) per capita grew only at a rate of 1% per

year from 1908 to 1957. Even though the real GDP grew at a rate of 3.9% per year

from 1950 to 1972, the real GDP per capita grew at only 1.7% per year. Its economic performance was the poorest of Latin

America’s large and medium-sized countries.” (Seiglie Chilean Strategic

Culture: The Influence of the Economy 4)

So even though we as the US

experienced this same urbanization, we had a very different outcome. We didn’t

suffer from high inflation rates and minimal growth. We became the world

economic superpower because of it.

But why did we get away with it?

What made the USA grow and what held up Chile? This is where it gets cloudy.

Macroeconomists, like scientists, have to try and hold variables constant in

order to test other ones. And when it comes to a macro-economy… they aren’t

afforded the luxury of a government holding GDP constant or maintaining money

supply.

The most popular theory is the runaway

spending by government. Other economists blame the populace. But in the end it

all ends with how fast money travels. While spending is good, too much can be

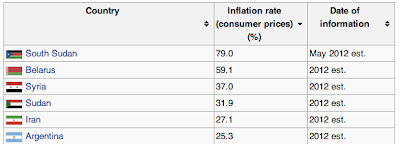

harmful. Modern day examples are included in the table below.

I hope you found this helpful,

informative, and maybe even… fun? Let me know what you think. Leave a comment!

Over and Out

Next Post: What happens when you

have hyper… suburbanization? The Detroit problem.

looking forward to what you have to say about Detroit man

ReplyDeleteGracias por compartir! Estas instruyendo a tu mama!! Te amo!

ReplyDelete