Good Evening!

I want to begin with three announcements. 1, I guess I just made the decision to make this blog a bi-

weekly thing. Cool? Cool. 2, I think I want to start making my posts spaced... easier reading. Cool?

Cool.

3, I'm a liar.

Ok that was a little strong.

Fibber? i'll take it.

How about overly ambitious... I like that one!

I'm not going to write about Detroit today, not because I don't like the issue. I want to pursue it. But I

think that before I tackle that monster, I want to do a quick lesson on taxation and drop a little factoid.

Cool? Cool.

Let's begin. I was strolling through the mall with the parents today when I came across a book stand

sitting as a kiosk when I asked myself "What is with the serious lack of book stores here in Chile?" I'm

not sure if my fellow study abroad companions have realized this themselves but finding a good book

to read (in print) is REALLY HARD! Your options are buying them via internet retailers or stumbling

across tables set up in allies with used books scattered on them. I just paid $14 bucks today for a used

paperback Published in 1992! (Doce Cuentos Peregrinos- Gabriel Garcia Marquez) So someone please tell me what is up?!

Just kidding.

I guess that's my job.

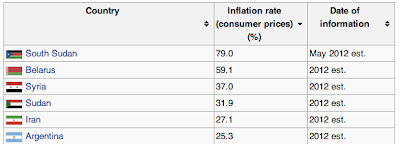

Chile, during their dictatorship under Pinochet (December of 1976), placed a 19% VAT on all books...

Let's see how that compares to other countries.

Now why would a dictatorship do that?

If the answer is glaringly obvious, snaps for you.

If not, let's talk taxes.

Taxes play an important role in our daily lives. We use them to create income for the government!

That's how we get our nice paved roads, free schooling, you know that. But let's discuss another lesser

known function of taxes. Yes it's glaringly obvious that taxes raise prices, what isn't obvious is that

taxes can be used to discourage behavior. Which is just a result of prices rising. But on a free market, it

leads to dead-weight loss. Let's look at the following as an illustrated example.

I want to begin with three announcements. 1, I guess I just made the decision to make this blog a bi-

weekly thing. Cool? Cool. 2, I think I want to start making my posts spaced... easier reading. Cool?

Cool.

3, I'm a liar.

Ok that was a little strong.

Fibber? i'll take it.

How about overly ambitious... I like that one!

I'm not going to write about Detroit today, not because I don't like the issue. I want to pursue it. But I

think that before I tackle that monster, I want to do a quick lesson on taxation and drop a little factoid.

Cool? Cool.

Let's begin. I was strolling through the mall with the parents today when I came across a book stand

sitting as a kiosk when I asked myself "What is with the serious lack of book stores here in Chile?" I'm

not sure if my fellow study abroad companions have realized this themselves but finding a good book

to read (in print) is REALLY HARD! Your options are buying them via internet retailers or stumbling

across tables set up in allies with used books scattered on them. I just paid $14 bucks today for a used

paperback Published in 1992! (Doce Cuentos Peregrinos- Gabriel Garcia Marquez) So someone please tell me what is up?!

Just kidding.

I guess that's my job.

Chile, during their dictatorship under Pinochet (December of 1976), placed a 19% VAT on all books...

Let's see how that compares to other countries.

(source: Fundación La Fuente)

Now why would a dictatorship do that?

If the answer is glaringly obvious, snaps for you.

If not, let's talk taxes.

Taxes play an important role in our daily lives. We use them to create income for the government!

That's how we get our nice paved roads, free schooling, you know that. But let's discuss another lesser

known function of taxes. Yes it's glaringly obvious that taxes raise prices, what isn't obvious is that

taxes can be used to discourage behavior. Which is just a result of prices rising. But on a free market, it

leads to dead-weight loss. Let's look at the following as an illustrated example.

A Market in Equilibrium

This market is in equilibrium, the amount supplied is equal to the amount demanded and everyone is happy.

Taxation

The cube we see when multiplied for area is the Tax Revenue the gov't earns while that triangle

describes the dead-weight loss. Dead weight loss is "The cost to society created by market

inefficiency" (investopedia.com). These are the effects of markets not working freely.

An important exception that we need to briefly discuss are Pigovian taxes. These are nothing more

than taxes without Dead-weight loss. This is the answer to your maybe lingering question, what cost

does society bear when cigarettes and alcohol are taxed? The government implements vice taxes to cut

back on consumption on things are dangerous (Second hand smoking and driving under the influence).

An Example:

|

| Source: BYU Idaho |

We see here that the market quantity is less than the social optimal, so in a real world example... before

cigarette taxes were enacted, there were more cigarettes on the streets than there should have been. So

the government cuts back on the market amount and tah dah! We have a social optimal.

So with those two concepts out of the way we can get to the more accessible part of the argument.

Why tax books?

Well as mentioned earlier, this was enacted during a dictatorship. A dictatorship that was placed 3

years after a communist leader was democratically elected in Chile. So it was in Pinochet's best interest

that the public wasn't reading! If no new ideas were entering Chile, it was much easier to manage civil

disobedience.

The Effects:

Source: Fundacion La Fuente

The title reads: If the books didn't have the VAT, would you buy more? The results speak for

themselves as 53.7% of respondents would probably buy more. But where do those who want

paperback books go?

Remember when I brought up the street vendors?

Instead of people waiting in line at big chain book stores (which really do not exist here in Chile) for

the newest big hit novel, we have people like me going into the park and buying from an improvised

book store. No no no I'm not some rogue consumer, these book stores aren't touched by authorities.

But that doesn't mean there isn't a problem. Books not entering the hands of the public is a social

injustice that has to be addressed immediately. The poorest Chileans will go years without seeing a

paper back unless the government enacts reform. But what is taking the Chilean government 23 more

years to instill change? Your guess is as good as mine.

Remember! Thought's, comments, compliments, insults (keep them clean)... you know where to put

'em.

Over and Out.